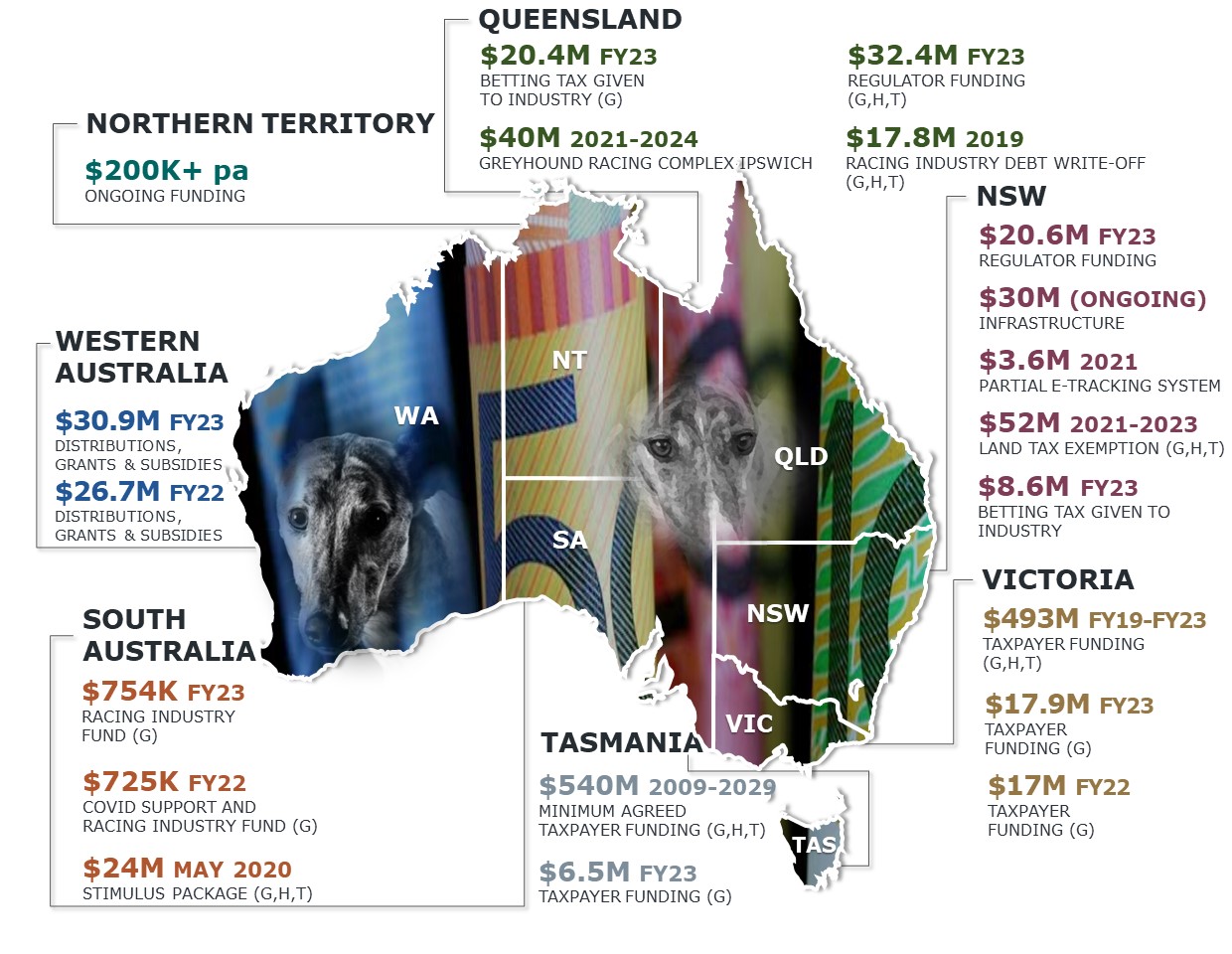

The map below follows the money trail direct from government to the gambling industry and back again.

Australian state governments artificially inflate prize money, pay breeding incentives, prop up financially failing clubs and build unwanted racetracks. And there is very little welfare oversight of the industry that receives all this financial support.

Click on the dollar amount for more funding information. Following the map is a .pdf that includes links to source material.

Blood money

Click on the dollar amount for more information on how state governments pour millions of taxpayer dollars into keeping the brutal greyhound racing industry afloat. Where government funding is shared across racing codes, this is indicated in brackets: Greyhound (G), Harness (H) and Thoroughbred (T).

A taxpayer funded industry

In FY23, $161 million of taxpayer money was given to Racing Queensland. This was a 50% increase in taxpayer funding over FY22. This is money that could and should be used to support areas that are of critical importance to most Queenslanders: healthcare, education, infrastructure. But the taxpayer handouts continue.

$118 million was raised via a point of consumption tax (POCT) which is a tax on Queenslanders’ betting losses. In June 2022, the Queensland government announced an increase in the POCT from 15% to 20% with a massive 80% of POCT raised given to Racing Queensland.

According to a 2021 Racing Queensland Investment Growth Plan, the greyhound racing industry receives 17.3% of the POCT funding. This amounted to $20.4 million in FY23.

In December 2022, Queensland Racing Minister Grace said the funding model has allowed Racing Queensland to bolster prize money, and that she was pleased to announce there will be a $31 million increase in prize money across all codes next year. The announcement goes onto list the specific prize money increases, there is no mention of animal welfare.

Ipswich Racetrack

In October 2019 the Queensland government announced its support for a new greyhound racing track at Ipswich. They also announced that the track will be funded with $40 million of taxpayer money.

There has been widespread community opposition to the track including a petition which gathered 73,000 signatures. In November 2023, industry media reported that the cost of the new Purga track has blown out to $60 million.

Debt write-off

In late 2018, Racing Queensland Chairman Steve Wilson AM said, “Despite increasing returns to participants by $15.2 million over the past two years RQ remains a loss-making organisation.”

In 2019, the Qld State Government took further steps to prop up the industry with a $17.8 million debt write-off. This represented 50% of historical debt owed to the Government. The Government also made a one-off payment of $20 million to be invested in new greyhound and harness racing facilities.

Regulator funding

In April 2015, the Queensland government announced a Commission of Inquiry into the regulation of the Queensland greyhound racing industry following the discovery of incidents of live baiting. A primary recommendation was the separation of the commercial and integrity aspects of the industry.

As a result, the taxpayer-funded Queensland Racing Integrity Commission (QRIC) was established in June 2016. While QRIC is an independent body responsible for animal welfare, it states that it “exists to contribute to the ongoing success of the racing industry in Queensland”. This highlights the conflict of interests that still exists.

In FY23, the Queensland government funded QRIC with $32.37 of taxpayer money comprised of:

• Queensland Government grant of $30.09 million

• Services received below fair value (services provided by Queensland Police Service (QPS) Racing Crime Squad and QPS Rural and Stock Crime Squad) of $278k

Regulator funding

The Greyhound Industry Reform Panel recommended the establishment of an independent greyhound racing regulator to try and reduce the systematic animal cruelty and mass killing exposed in 2015.

The NSW Greyhound Welfare and Integrity Commission was established in 2018. Initially, GWIC was funded by Greyhound Racing NSW but in June 2021, the NSW racing minister Kevin Anderson announced $25 million for a new taxpayer funded model. According to the minister this would free up millions of dollars which can be reinvested in facilities and prizemoney.

In FY22/23 the NSW Government provided funding of $20.6m to GWIC made up of:

- $11.1m – POCT from GRNSW

- $9.5m – Treasury funding via Department of Enterprise, Investment and Trade

Deadly tracks

In June 2017, the NSW Government announced a five-year $30m taxpayer funded Racing Capital Grants Program designed to bring all greyhound racing tracks up to minimum standards. However, it wasn’t until June 2020 that Greyhound Racing NSW released its Minimum Standards for Racecourse Design and Construction.

According to the Office of Racing, as at February 2024, the NSW Government has funded projects under the Racing Capital Grants Program at a total cost of $10.9m. This leaves a balance of $19.1m of taxpayer money which was to have been used to bring racing tracks up to minimum standards by 30 June 2023.

Millions of taxpayer dollars continue to be wasted trying to make tracks safe, with dogs still being killed and injured after upgrades. Designs from University of Technology Sydney are claimed to make tracks safer, but dogs still die and suffer on these tracks.

All greyhound racetracks are unsafe, whether upgraded or not. The industry rejects the safest form of racing – a straight track with individual lanes.

Missing, feared killed

In February 2021 racing minister Kevin Anderson announced a $3.6 million taxpayer-funded electronic tracking system to protect greyhounds from unnecessary euthanasia.

However, the system only tracks greyhounds until “de-registration” which does not reflect the greyhound lifecycle which extends from birth, through retirement, to death.

The NSW partial tracking system does not track puppies prior to microchipping, greyhounds sent interstate or greyhounds that are rehomed privately by their owners.

In May 2021 a Bill was introduced by Greens NSW which will allow genuine whole-of-life tracking from birth to death of all greyhounds that have been involved in the racing industry.

Tax given to industry

In January 2019, the New South Wales government introduced a point of consumption tax (POCT) of 10% on all wagering revenue. The POCT was implemented as a way of closing a loophole in existing laws whereby most online bets were not taxed.

In an agreement with the racing industry, the New South Wales government gave 20% of the POCT to the racing industry. All money that should be spent on areas of critical importance to the community including healthcare, education, infrastructure.

In June 2022, the NSW POCT increased to 15% with 33% passed on to the racing industry. In FY23, this amounted to $8.6m given directly to Greyhound Racing NSW with additional POCT used to fund the Greyhound Welfare and Integrity Commission.

Squandering taxpayer money

The Victorian government has given hundreds of millions of taxpayer dollars to the racing industry. Over the past five years, this amounts to around half a billion dollars. Much of this was gifted to the industry via the Victorian Racing Infrastructure Fund along with millions in prizemoney and grants to keep the industry solvent.

On 1 January 2019 the Victorian government implemented a point of consumption tax (POCT) on wagering and sports betting. From July 2021, the POCT applied at a rate of 10% of net wagering revenue with 3.5% passed on to the Victorian racing industry.

With their COVID-19 survival package, the Victorian Government prioritised gambling and animal exploitation over sport, culture and tourism. The Victorian racing industry received $44 million, the largest slice of the $150 million taxpayer-funded pie.

Every cent of this taxpayer money could and should be spent on fixing roads, healthcare, education, aged care and other areas that are critical to the entire community.

The assumption that gambling tax should be “ring-fenced” and only used to support the racing industry is without merit. If we followed this line of reasoning, then alcohol tax should only be used to build breweries rather than benefit the wider community.

Racing more important than the homeless

In FY23 Greyhound Racing Victoria received $17.9 million of taxpayer money. $2.7 million derived via the Victorian Racing Infrastructure Fund and $15.2 million via the point of consumption betting tax.

In FY22 GRV received $17 million of taxpayer money. $1.5 million derived via the Victorian Racing Infrastructure Fund and $15.5 million via the point of consumption betting tax.

As part of the Inquiry into the 2023–24 Budget Estimates held in June 2023, Racing Minister David Harris was asked why the racing industry will get an extra $120 million per year which is four times the funding allocated to homelessness and housing services. He responded by saying that the racing industry employs 35,000 people across the state. This is a significant exaggeration with the 2021 ABS census showing 3120 people full time employed in the Victorian racing industry.

What Minister Harris also failed to mention was that the Victorian racing industry is very adequately funded by the gambling industry. This amounted to over $500 million in FY23 alone with $54 million going to the greyhound racing industry.

A loss making industry

TasRacing is funded primarily by the Tasmanian taxpayer via an Annual Industry Funding Grant. The Grant provides the industry with a minimum of $27 million a year over a 20-year period, increasing by CPI annually.

A Government inquiry into the performance of Tasracing highlighted numerous issues with the funding agreement including that: “The ongoing indexed $27 million funding model fails to tie funding to performance and is irrespective of revenue earned.”

The latest increase in taxpayer funding for the industry was announced in September 2022. This is despite growing resistance by Tasmanian taxpayers. A parliamentary petition in June 2022 calling for an end to public funding of greyhound racing amassing more than 13,500 signatures, the most of any e-petition tabled to parliament.

In 2023, the estimated cost of a proposed greyhound and harness racing track in the state’s north-west jumped from $18 million to $38.6 million, with rising construction costs blamed. The Tasmanian state government has committed $8 million of taxpayer money to the track with Tasracing asking the government for more money.

Greyhound Racing SA chairman Grantley Stevens and SA Racing Minister Corey Wingard at the opening of the Murray Bridge track in July 2019 which saw the death of a greyhound. (Photo: Greyhound Racing SA)

SA Racing no longer claims it’s “clean”

In June 2019, Racing Minister Corey Wingard delivered a $24 million package to the SA racing industry. The Minister spoke of the important work of the racing industry and how the Government would help to strengthen the viability of its business model. This was despite the Government having minimal oversight into the welfare of animals involved in the racing industry.

Unlike other states which responded to the 2015 NSW live baiting scandal with comprehensive inquiries into the industry, the SA Government refused to support an independent inquiry. That changed in 2023 when it was forced to announce an inquiry due to the exposure of animal abuse and live baiting in the SA greyhound racing industry. The resulting report made 57 recommendations which the industry must implement in two years or face closure.

Taxpayers supporting a brutal industry

A 15% point of consumption tax (POCT) applies to South Australians’ betting losses. A percentage of the POCT is given to the SA racing industry. In June 2023, the SA Labor Government, led by Peter Malinauskas, announced an increase in the POCT from 10% to 20% commencing July 2023.

A month later, the SA government launched an inquiry into Greyhound Racing SA after a leading trainer was shown kicking and punching greyhounds, including puppies, on a property south-east of Adelaide. This followed three SA trainers being given lifetime bans after a live baiting scandal.

In December 2023 the inquiry handed down 57 recommendations, with an additional 29 from Greyhound Racing SA, the RSPCA and the Animal Justice Party. Based on the results of the inquiry, the South Australian government has given the greyhound racing industry two years to improve its standards, or it will be banned.

GRSA is also the only racing body in Australia that remains exempt from FOI, aside from the Northern Territory. This allows it to operate in secrecy.

This is not a self-funded industry

Claims that greyhound racing is self-funded are simply not true.

For example, the WA racing industry including greyhound racing is funded primarily via profits made by the Government-owned WA TAB. This is supplemented by income generated via the race bets levy paid by national wagering operators and proceeds from the point of consumption wagering tax. This is all taxpayer money that could be spent on areas of critical importance to the WA community like health, education and infrastructure.

Over FY22 and FY23, the WA state government gave the greyhound racing industry $57.6 million of taxpayer money.

Investigation into Darwin Greyhound Association

The Darwin Greyhound Association operates the only registered NT track at Winnellie. They receive hundreds of thousands of dollars a year from the NT Government.

In 2020, the NT Racing Commission launched an investigation into the Darwin Greyhound Association (DGA) following a series of allegations made by current and former members and trainers.

The investigation found that NT greyhound racing “does not have adequate policies and procedures in place to ensure best practice animal welfare standards are being adhered to.”

The report exposed an industry operating with little or no concern for animal welfare. It also revealed a regulator with few strategic or operational guidelines in place to protect greyhounds from injury, unnecessary euthanasia and doping; and promote adequate housing and medical care.

Land Tax Exemption

The NSW Government grants a land tax exemption for land owned by or held in trust for any club for promoting or controlling horse racing, trotting or greyhound racing which is used primarily for the purposes of their meetings. This will amount to $52 million over three years from 2021 to 2023.

A taxpayer-funded industry

In FY23, the Tasmanian government funded the racing industry with $41 million of taxpayer money including $33.92 million under the Annual Industry Funding Grant and $7 million point of consumption tax.

The Tasmanian greyhound racing industry received $6.5 million which was an increase of 10% on the previous year. This increase was used to increase prizemoney for participants.

In June 2022, a petition was tabled demanding an end to taxpayer funding of greyhound racing in Tasmania. The petition received more signatures than any other parliamentary petition. Despite this the Tasmanian Racing Minister announced in September 2022 that taxpayer funding for the industry will increase by 8%.

In October 2023, the most comprehensive opinion poll ever conducted into greyhound racing in Tasmania revealed overwhelming public opposition to dog racing. The survey was conducted by EMRS, Tasmania’s leading polling and research organisation. The survey found that three quarters of all Tasmanians oppose government funding of the greyhound race industry, including 55 per cent who say they are strongly opposed to it.